| | |

| 5 | | Executive Compensation Matters (continued) |

In May 2017 FAMPYRA was approved for walking improvement in people with MS by the EC.

In August 2017 IMRALDI, an adalimumab biosimilar referencing HUMIRA developed through our joint venture, Samsung Bioepis, was approved by the EC.

Clinical Trials

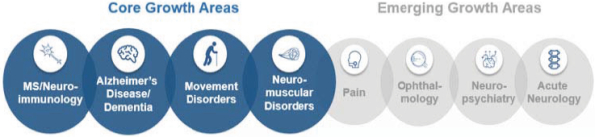

MS and Neuroimmunology

In January 2017September 2018 we completed enrollment of the Phase 2b AFFINITY study evaluating opicinumab, anti-LINGO, as anadd-on therapy in MS patients who are adequately controlled on their anti-inflammatory disease-modifying therapy (DMT), versus the DMT alone.

In November 2018 we initiated athe Phase 1 trial3b NOVA study evaluating the efficacy and safety of BIIB076, ananti-tau monoclonal antibody,extended interval dosing (every six weeks) for natalizumab compared to standard interval dosing in healthy volunteerspatients with RMS and participants with Alzheimer’s disease.

In June 2017 we dosed ourenrolled the first patient in December 2018.

In December 2018 we dosed the first patient in a bioequivalence study to test whether exposure levels of PLEGRIDY are maintained with intramuscular administration.

Neuromuscular Disorders

| • | | In September 2018 we enrolled the first patient in the Phase 1 study evaluating BIIB078(IONIS-C9Rx), an antisense oligonucleotide (ASO) drug candidate, in adults with C9ORF72-associated ALS. |

| • | | In December 2018 we and our collaboration partner Ionis Pharmaceuticals, Inc. (Ionis) announced results from a positive interim analysis of the ongoing Phase 1 study of BIIB067 (IONIS-SOD1Rx), an investigational treatment for ALS with superoxide dismutase 1 (SOD1) mutations. The interim analysis showed that, over a three-month period, BIIB067 resulted in a statistically significant lowering of SOD1 protein levels in the cerebrospinal fluid and a numerical trend towards slowing of clinical decline as measured by the ALS Functional Rating Scale Revised, both compared to placebo. |

Alzheimer’s Disease and Dementia

In May 2018 we initiated a Phase 2 study of BIIB092 for Alzheimer’s disease.

In June 2018 we and our collaboration partner Eisai Co., Ltd. (Eisai) announced that elenbecestat, the oral BACE (beta amyloid cleaving enzyme) inhibitor, demonstrated an acceptable safety and tolerability profile in the Phase 2 study, and the results demonstrated a statistically significant difference in amyloid-beta levels in the brain measured byamyloid-PET (positron emission tomography). A numerical slowing of decline in functional clinical scales of a potentially clinically important difference was also observed, although this effect was not statistically significant.

In December 2017 we and our collaboration partner Eisai announced that the Phase 2 study of BAN2401, a monoclonal antibody targeting tau,that targets amyloid beta aggregates, an Eisai product candidate for PSP.

the treatment of Alzheimer’s disease, did not meet the criteria for success based on a Bayesian analysis at 12 months as the primary endpoint in an856-patient Phase 2 clinical study, an endpoint that was designed to enable a potentially more rapid entry into Phase 3 development. In July 20172018, based upon the final analysis of the data at 18 months, we and Eisai announced that the topline results from the Phase 2 study demonstrated a statistically significant slowing in clinical decline and reduction of amyloid beta accumulated in the brain. The study achieved statistical significance on key predefined endpoints evaluating efficacy at 18 months on slowing progression in Alzheimer’s Disease Composite Score (ADCOMS) and on reduction of amyloid accumulated in the brain as measured usingamyloid-PET.

In July 2018 we completed enrollment of ENGAGE and EMERGE, the Phase 3 studies of aducanumab. In March 2019 we and our collaboration partner Eisai announced that we were discontinuing the EMERGE and ENGAGE Phase 3 studies.

Movement Disorders

In January 2018 we dosed the first patient in the Phase 12 SPARK study of BIIB054,a-synuclein antibody, in both healthy volunteers and patients with early onset Parkinson’s disease.

In October 2017September 2018 we initiatedcompleted enrollment of the Phase 2b clinical trial AFFINITY, designed to evaluate opicinumab,anti-LINGO-1, as an investigationaladd-on therapy2 PASSPORT study of BIIB092 for PSP.

Acute Neurology

In March 2018 we dosed the first patient in people with relapsing MS.

In October 2017 we initiated the Phase 2 OPUS study evaluating the efficacy, safety and tolerability of natalizumaba4-integrin inhibitor, in drug-resistant focal epilepsy.

Business Development

In January 2017September 2018 we entered into a settlement and license agreement with Forward Pharma A/S (Forward Pharma). Pursuant to this agreement, we obtained U.S. and rest of world licenses to Forward Pharma’s intellectual property, including Forward Pharma’s intellectual property related to TECFIDERA.

In May 2017 we completed an asset purchase ofenrolled the first patient in the Phase3-ready candidate 3 CHARM study of BIIB093, (intravenous glibencamide) (formerly known as CIRARA) from Remedy Pharmaceuticals Inc. The target indication for BIIB093 isglibenclamide IV, in large hemispheric infarction, a severe form of ischemic stroke where brain swelling (cerebral edema) often leads to a disproportionately large share of stroke-related morbidity and mortality. The U.S. Food and Drug Administration (FDA) recently granted BIIB093 Orphan Drug Designation for severe cerebral edema in patients with acute ischemic stroke. The FDA has also granted BIIB093 Fast Track designation.

In June 2017 we completed an exclusive license agreement with Bristol-Myers Squibb Company for BIIB092 (formerly known asBMS-986168), a Phase2-ready experimental medicine with potential in Alzheimer’s disease and PSP. BIIB092 is an antibody targeting tau, the protein that forms the deposits, or tangles, in the brain associated with Alzheimer’s disease and other neurodegenerative tauopathies such as PSP.

In October 2017 we entered into a new collaboration agreement with Eisai Co. Ltd. (Eisai) for the joint development and commercialization of aducanumab, our anti-amyloid beta antibody candidate for Alzheimer’s disease. Under this agreement, we will continue to lead the ongoing Phase 3 development of aducanumab and will remain responsible for 100% of development costs for aducanumab until April 2018. Eisai will then reimburse us for 15% of aducanumab development expenses for the period April 2018 through December 2018, and 45% thereafter. Upon commercialization, both companies willco-promote aducanumab with a region-based profit split.

In October 2017 we amended the terms of our collaboration and license agreement with Neurimmune Subone AG (Neurimmune). Under the amended agreement, we made a $150.0 million payment to Neurimmune in exchange for a 15% reduction in royalty rates payable on products developed under the agreement, including on potential commercial sales of aducanumab. Our royalty rates payable on products developed under the agreement, including on potential commercial sales of aducanumab, will now range from the high single digits tolow-teens.

In November 2017 we entered into an exclusive license and collaboration agreement with Alkermes Pharma Ireland Limited, a subsidiary of Alkermes plc, for BIIB098 (formerly known as ALKS 8700), an oral monomethyl fumarate prodrug in Phase 3 development for the treatment of relapsing forms of MS.

In December 2017 we entered into a new collaboration agreement with Ionis to identify new antisense oligonucleotide (ASO) drug candidates for the treatment of SMA. Under this agreement, we have the option to license therapies arising out of this collaboration and will be responsible for the development and commercialization of these therapies.

Capital Allocation

In February 2017 we completed thespin-off of our hemophilia business, Bioverativ Inc., as an independent, publicly traded company.

Returned approximately $1.4 billion to stockholders in 2017 through share repurchases.

Announced a corporate restructuring program intended to streamline our operations and reallocate resources.

| | | | |

3133 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

Neurocognitive Disorders

In December 2018 we dosed the first patient in our Phase 2b study of BIIB104 (AMPA) in CIAS.

Pain

In March 2018 we initiated a Phase 1 study of BIIB095, a Nav 1.7 inhibitor for neuropathic pain.

In May 2018 we initiated a Phase 2 study of vixotrigine (BIIB074) in small fiber neuropathy.

Other

In September 2018 we dosed the first patient in the Phase 2b study of BG00011(STX-100) in idiopathic pulmonary fibrosis, a chronic irreversible and ultimately fatal disease characterized by a progressive decline in lung function.

Discontinued Programs

In February 2018 we announced that the Phase 2b dose-ranging ACTION study investigating natalizumab in individuals with acute ischemic stroke (AIS) did not meet its primary endpoint. Based on these results, we discontinued development of natalizumab in AIS. The results of the Phase 2b ACTION study do not impact the benefit-risk profile of natalizumab in approved indications, including MS.

In October 2018 we announced that we completed the Phase 2b study of vixotrigine (BIIB074) for the treatment of painful lumbosacral radiculopathy (PLSR). The study did not meet its primary or secondary efficacy endpoints and we discontinued development of vixotrigine for the treatment of PLSR. The safety data were consistent with the safety profile reported in previous studies.

Business Development

In January 2018 we acquired BIIB100 from Karyopharm Therapeutics Inc. BIIB100 is a Phase 1 ready investigational oral compound for the treatment of certain neurological and neurodegenerative diseases, primarily in ALS. BIIB100 is a novel therapeutic candidate that works by inhibiting a protein known as XP01, with the goal of reducing inflammation and neurotoxicity, along with increasing neuroprotective responses.

In April 2018 we acquired BIIB104 from Pfizer Inc. BIIB104 is afirst-in-class, Phase 2b ready AMPA receptor potentiator for CIAS, representing our first program in neurocognitive disorders. AMPA receptors mediate fast excitatory synaptic transmission in the central nervous system, a process which can be disrupted in a number of neurological and psychiatric diseases, including schizophrenia.

In June 2018 we closed a10-year exclusive agreement with Ionis to develop novel ASO drug candidates for a broad range of neurological diseases (the 2018 Ionis Agreement). We have the option to license therapies arising out of the 2018 Ionis Agreement and will be responsible for the development and potential commercialization of such therapies.

In June 2018 we entered into an exclusive option agreement with TMS Co., Ltd. granting us the option to acquireTMS-007, a plasminogen activator with a novel mechanism of action associated with breaking down blood clots, which is in Phase 2 development in Japan, and backup compounds for the treatment of stroke.

In June 2018 we exercised our option under our joint venture agreement with Samsung BioLogics to increase our ownership percentage in Samsung Bioepis from approximately 5% to approximately 49.9%. The share purchase transaction was completed in November 2018.

In July 2018 we acquired BIIB110 (Phase 1a) andALG-802 (preclinical) from AliveGen Inc. BIIB110 andALG-802 represent novel ways of targeting the myostatin pathway. We initially plan to study BIIB110 in multiple neuromuscular indications, including SMA and ALS.

In December 2018 we exercised our option with Ionis and obtained a worldwide, exclusive, royalty-bearing license to develop and commercialize BIIB067, an investigational treatment for ALS with SOD1 mutations.

In December 2018 we entered into a collaborative research and license agreement with C4 Therapeutics (C4T) to investigate the use of C4T’s novel protein degradation platform to discover and develop potential new treatments for neurological diseases, such as Alzheimer’s disease and Parkinson’s disease. We will be responsible for the development and potential commercialization of any therapies resulting from this collaboration.

| | | | |

| 34 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

Leadership TeamShare Repurchase Activity

At the core

In August 2018 our Board of what we do areDirectors authorized a program to repurchase up to $3.5 billion of our peoplecommon stock (2018 Share Repurchase Program). Our 2018 Share Repurchase Program does not have an expiration date. All share repurchases under our 2018 Share Repurchase Program will be retired.

We returned approximately $4.4 billion to stockholders in 2018 through share repurchases under our 2018 Share Repurchase Program and our leaders. As2016 Share Repurchase Program, which was a result,program authorized by our goal isBoard of Directors in July 2016 to findtop-tier talent with the skills necessaryrepurchase up to imagine$5.0 billion of our common stock and lead us into the future. We advanced this goal in 2017 by appointing several new executives in key roles. These appointments included:which was completed as of June 30, 2018.

• | | Michel Vounatsos, Chief Executive Officer, formerly Executive Vice President, Chief Commercial Officer.Mr. Vounatsos joined us in April 2016 as our Executive Vice President, Chief Commercial Officer after a20-year career with Merck and became our Chief Executive Officer in January 2017. While at Merck, he held leadership positions of increasing responsibility in Europe, China and the U.S., driving significant and consistent growth across multiple geographies. We believe that his significant knowledge and experience with respect to the biotechnology, healthcare and pharmaceutical industries, and his comprehensive leadership background, will guide Biogen in the next phase of its evolution. |

• | | Jeffrey D. Capello, Executive Vice President and Chief Financial Officer.Mr. Capello joined us in December 2017 as our Executive Vice President and Chief Financial Officer, bringing 26 years of experience in finance. Most recently he was Executive Vice President and Chief Financial Officer of Beacon Health Options Inc. His previous experience includes founding and running his own company, Monomy Advisors, and serving as Chief Financial Officer of Ortho Clinical Diagnostics, Boston Scientific Corporation and PerkinElmer. Earlier in his career he was a partner in the Boston and Amsterdam offices of PwC. We believe that Mr. Capello’s strong public company financial experience will allow him to play a critical role as we aim to execute on our business strategy, pursue business development opportunities and build our pipeline. |

• | | Ginger Gregory, Executive Vice President and Chief Human Resources Officer.Dr. Gregory joined us as our Executive Vice President, Chief Human Resources Officer in July 2017, bringing over 20 years of human resources experience to Biogen. She was most recently the Chief Human Resources Officer at Shire Pharmaceuticals. Prior to that, Dr. Gregory held executive-level human resources positions for several multinational companies across a variety of industries, including Dunkin’ Brands, where she served as Chief Human Resource Officer; Novartis, AG, where she was the division head of Human Resources for Novartis Vaccines and Diagnostics, Novartis Consumer Health and Novartis Institutes of BioMedical Research; and Novo Nordisk, where she served as Senior Vice President, Corporate People & Organization at the company’s headquarters in Copenhagen, Denmark. We believe that Dr. Gregory’s extensive experience in the biotechnology and pharmaceutical industries will be valuable as we endeavor to attract, develop and retain a talented, culturally diverse workforce to execute on our mission to transform neuroscience and the treatment of neurological diseases. |

• | | Chirfi Guindo, Executive Vice President and Head of Global Marketing, Market Access and Customer Innovation.Mr. Guindo joined us as our Executive Vice President and Head of Global Marketing, Market Access and Customer Innovation in November 2017. Mr. Guindo brings 27 years of experience in the global pharmaceutical industry and has held several leadership positions at Merck (known as MSD outside Canada and the U.S.) in Canada, the U.S., France, Africa and the Netherlands. He has worked in several disciplines including Finance, Sales & Marketing, General Management and Global Strategy/Product Development in specialty, acute and hospital care. Most recently Mr. Guindo was President & Managing Director of Merck Canada. We believe that Mr. Guindo’s extensive experience in the global pharmaceutical industry will help us further our leadership in MS and SMA, plan for our Alzheimer’s disease franchise and pursue future pipeline opportunities. |

Other Notable Achievements in the Workplace and Community

Awarded with our collaboration partner Ionis, the 20172018 International Prix Galien USA Award foras Best Biotechnology Product for SPINRAZA. The prestigious honor marks the seventh Prix Galien for SPINRAZA, following country recognitions in the U.S., Germany, Italy, Belgium-Luxembourg, the Netherlands and the U.K. The International Prix Galien is given every two years by Prix Galien International Committee members in recognition of excellence in scientific innovation to improve human health.

Named the Biotechnology Industry Leader on the Dow Jones Sustainability World Index.

Recognized as a corporate sustainability leader with Gold Class and Industry Mover Sustainability Awards from RobecoSAM.

Continued commitment to operational carbon neutrality highlighted bythrough the use of 100% renewable electricity globally.

Committed to reduce carbon emissions by a targeted amount approved by the Science Based Target Initiative, to align ourselves with the global goal of limiting global temperature rise to under two degrees Celsius.

Recognized as a corporate sustainability leader with naming toEarned CDP scores of A,A- and B in the CDP A List for bothareas of Supplier Engagement, Climate Change and Water, and receiving RobecoSAM Silver Class and Industry Mover distinctions.respectively.

Earned a perfect score of 100% on the Human Rights Campaign’s Corporate Equality Index (a national benchmarking tool on corporate policies and practices pertinent to LGBTQ employees) for the fourthfifth consecutive year.

Continued commitment to diversity and inclusion. As of December 31, 2018, 44% of Director-level positions and above were held by women.

Over 2,6003,200 employees volunteered from 2628 countries induring our annual Care Deeply Day.

Engaged 44,000+50,000+ students inhands-on learning to inspire their passion for science since the inception of Biogen’s Community Labs.

| | | | |

32 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

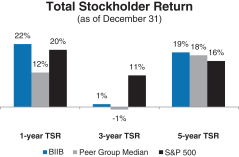

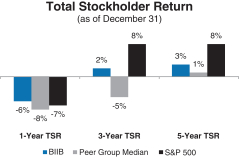

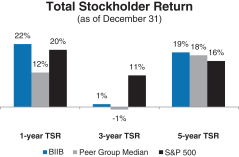

Total Stockholder Return

Ourone-, three- and five-year total stockholder return (TSR)* compared to our peer group and the Standard & Poor’s 500 (S&P 500) is set forth below.

* | TSR is a measure of performance over time that combines changes in share price and dividends paid to show the total return to the stockholder expressed as an annualized percentage. |

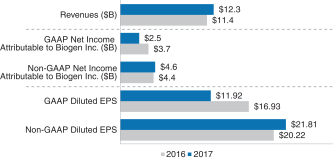

20172018 Executive Compensation Programs andPay-for-Performance Alignment

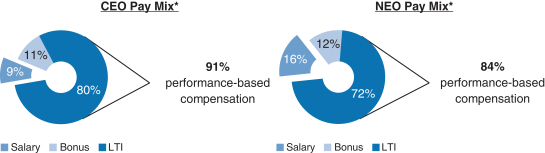

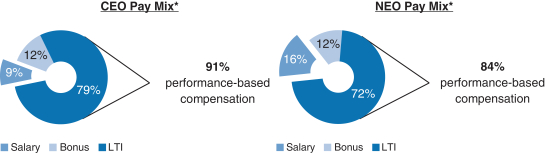

We believe our executive compensation programs are effectively designed and have worked well to implement apay-for-performance culture that is aligned with the interests of our stockholders. In 20172018 our executive compensation programs consisted of base salary, short- and long-term incentives and other benefits.

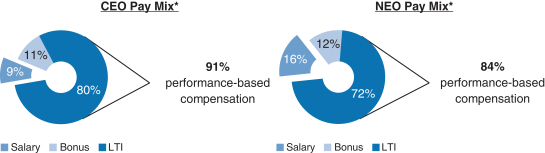

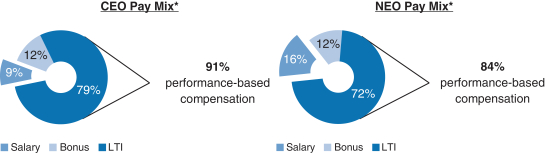

91% of our CEO’s and 84% of our other current NEOs’ 20172018 target compensation was performance-based andat-risk.

| | * | Reflects annual salary, target bonus and target grant date value of the 20172018 annual long-term incentive awards. The CEO compensation mix reflects compensation for Mr. Vounatsos, who has served as our CEO since January 6, 2017. The NEO compensation mix excludes Dr. McKenzie’stheone-time RSU award,transition awards of RSUs granted to Dr. Ehlers, Ms. Alexander and Dr. McKenzie, as described in further detail below, as well as compensation for Dr. Scangos and Messrs. Capello, Clancy and DiPietro due to partial year employment with Biogen in 2017 and compensation for Mr. Covino, due to his change in roles during 2017.below. |

| | | | |

3335 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

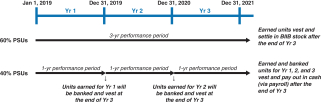

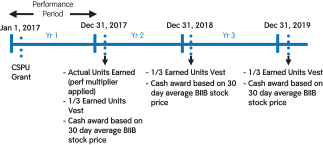

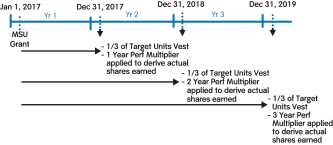

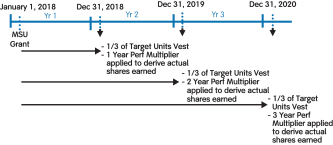

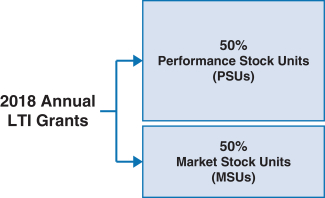

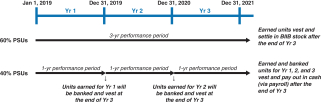

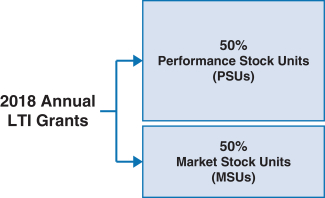

100% of our NEOs’ 2018 annual long-term incentive (LTI) grants were performance-based andat-risk.

| | |

| | • 60% earned based on achievement of three-year adjustedNon-GAAP diluted earnings per share (EPS) and pipeline milestone performance goals • 40% earned based on achievement of adjustedNon-GAAP free cash flows and revenues over threeone-year performance periods • PSUs were introduced in 2018. For more information on our PSUs, please see “Long-Term Incentives – 2018 PSUs” below. • Earned based on stock price performance over one, two and three year periods |

Our 20172018 performance-based compensation payouts align with our commitment to strong performance.

In 2017 overall2018 we achieved or exceeded the vast majority of the corporate performance goals that we set at the beginning of the year for our incentive compensation plans. As a result, the payouts, as a percentage of target, for our 20172018 annual bonus plan 2017 awarded cash-settledand the portions of our PSUs and MSUs that were eligible to be earned based on 2018 performance units (CSPUs) and 2017 awarded market stock units (MSUs) were above target payout amounts, as described in further detail below.

| | | | |

Annual Bonus Plan

130%*

Company Performance Multiplier

(The overall annual bonus plan multiplier for each NEO was further modified based on his/her individual performance multiplier)

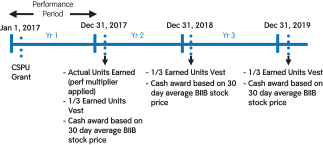

| | Cash-Settled Performance Units

123%*

Performance multiplier for the CSPUs

during the 2017 performance period

(Earned units are subject to three-year

time vesting from the grant date)

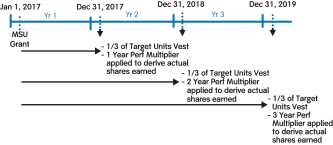

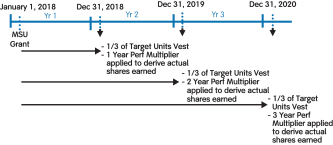

| | Market Stock Units

126%*

Performance multiplier for the MSUs during the 2017 performance period

|

* | Actual multiplier for applicable 2017 award based on corporate performance. |

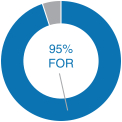

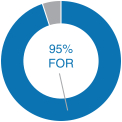

20172018 Advisory Vote on Executive Compensation

| | |

| At our 2018 annual meeting of stockholders, we continued to receive strong support for our executive compensation programs with approximately 95% of the votes cast for approval of our annual“say-on-pay” proposal. Our C&MD Committee viewed this as positive support for our executive compensation programs and their alignment with long-term stockholder value creation and determined that the Company’s executive compensation programs have been effective in implementing the Company’s stated compensation philosophy and objectives. | |

|

Our C&MD Committee is committed to continually reviewing our executive compensation programs on a proactive basis to ensure the ongoing alignment of such programs with the interests of our stockholders. |

| In 2018 our C&MD Committee reviewed the external landscape, the results from our“say-on-pay” proposal at last year’s annual meeting of stockholders and the Company’s performance against the current compensation programs. Our C&MD Committee was satisfied that our existing compensation programs further ourpay-for-performance philosophy, but made certain enhancements to the design of our LTI program in 2018 to strengthen its focus on long-term performance and alignment with our stockholders’ interests. |

Specifically, under our 20172018 LTI program, grants of PSUs replaced grants of cash-settled performance units (CSPUs), which we had granted in previous years. The key changes are as follows:

PSU awards are subject to three-year cliff vesting as compared to annual meetingratable vesting over three years (1/3 per year) for CSPU awards;

60% of stockholders, we continuedPSU awards are earned over a three-year performance period based on the achievement of three-year cumulative performance goals for stock-settled PSU awards and 40% of PSU awards are earned over three annual performance periods based on the achievement of three sets of annual performance goals for cash-settled PSU awards as compared to receive support100% of CSPUs awards earned based upon one annual performance period for our executive compensation programs with approximately 97%CSPU awards; and

60% of the votes castPSU awards will be settled in stock and 40% of the PSU awards will be settled in cash as compared to 100% cash settlement for approval of our annual“say-on-pay” proposal. Our Compensation Committee viewed this as very positive support for our executive compensation programs and their alignment with long-term stockholder value creation and noted that the Company’s executive compensation programs have been effective in implementing the Company’s stated compensation philosophy and objectives.CSPU awards.

Our Compensation Committee is committed to continually reviewing our executive compensation programs on a proactive basis to ensure the ongoing alignment of such programs with the interests of our stockholders.

In 2017 we reviewed the external landscape, the results from our“say-on-pay” proposal at last year’s annual meeting of stockholders and the results of our current compensation programs. Our Compensation Committee was satisfied that our existing compensation programs further ourpay-for-performance philosophy, and, accordingly, did not recommend any significant changes to our executive compensation programs for 2017.

| | | | |

3436 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

For additional information on our PSU awards, please see “Long-Term Incentives – 2018 PSUs” below.

Roles and Responsibilities

Role of our CompensationC&MD Committee

Our CompensationC&MD Committee, which is composed of four independent directors, oversees and administers our executive compensation programs. In making executive compensation decisions, our CompensationC&MD Committee considersreviews a variety of factors and data, most importantly our performance and individual executives’ performance, and takes into accountconsiders the totality of compensation that may be paid. In addition, our CompensationC&MD Committee administers our annual bonus plan and our equity plans, reviews business achievements relevant to payouts under our compensation levels,plans, makes recommendations to our Board of Directors with respect to compensation policies and practices as well as the compensation of our CEO and seeks to ensure that total compensation paid to our executive officers is fair, competitive and aligned with stockholder interests. Our CompensationC&MD Committee retains the right to hire outside advisors as needed to assist it in reviewing and revising our executive compensation programs.

The duties and responsibilities of our CompensationC&MD Committee are described on page 1920 and can be found in our CompensationC&MD Committee’s written charter adopted by our Board of Directors, which can be found on our website,www.biogen.com, under the “Corporate Governance” subsection of the “Investors” section of the website.

Role of the Independent Compensation Consultant

Our CompensationC&MD Committee believes that independent advice is important in developing Biogen’sand overseeing our executive compensation programs. Frederic W. Cook & Co., Inc. (FW Cook) is currently engagedserved as our CompensationC&MD Committee’s independent compensation consultant.consultant until June 2018 and advised our C&MD Committee regarding compensation decisions in 2018. FW Cook did not provide any other services to Biogen. Pearl Meyer & Partners LLC (Pearl Meyer) has served as our C&MD Committee’s independent compensation consultant since June 2018 and has advised our C&MD Committee regarding compensation decisions since that time. Pearl Meyer does not provide any other services to Biogen.Biogen and engages in other matters as needed and as directed solely by our C&MD Committee. References in this CD&A to our independent compensation consultant refer to FW Cook for the period during which it was engaged and to Pearl Meyer thereafter.

Reporting directly to our CompensationC&MD Committee, FW Cookour independent compensation consultant provides guidance on trends in CEO, executive andnon-employee director compensation, the development of specific executive compensation programs and the composition of the Company’s compensation peer group. Additionally, FW Cookour independent compensation consultant prepares a report on CEO pay that compares each element of compensation to that of CEOs in comparable positions at companies in our peer group. Using this and other similar information, our CompensationC&MD Committee recommends, and our Board of Directors approves, the elements and target levels of our CEO’s compensation. FW Cook also engages in other matters as needed and as directed solely by our Compensation Committee.

During 20172018 the Company paid FW Cook $250,989and Pearl Meyer $123,275 and $47,666, respectively, in consulting fees directly related to these services. Our CompensationC&MD Committee assessesassessed FW Cook’s independence annually and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2017 that FW Cook’s work did not raise any conflicts of interest and that FW Cook remained independent under applicable rules. Our C&MD Committee assessed Pearl Meyer’s independence in connection with its engagement in June 2018 and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2018 that Pearl Meyer’s work did not raise any conflicts of interest and that Pearl Meyer remains independent under applicable rules.

Role of our CEO

Each year our CEO provides an assessment of the performance of each executive officer, other than himself, during the prior year and recommends to our CompensationC&MD Committee the compensation to be paid or awarded to each executive. Our CEO’s recommendations are based on numerous factors, including:

Company, team and individual performance;

potential for future contributions;

leadership competencies;

external market competitiveness;

internal pay comparisons; and

other factors deemed relevant.

To understand the external market competitiveness of the compensation for our executive officers, our CEO and our CompensationC&MD Committee review a report analyzing publicly-available information and surveys prepared by our internal

| | | | |

| 37 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

compensation group and reviewed by FW Cook.our independent compensation consultant. The report compares the compensation of each executive officer, other than our CEO, to data for comparable positions at companies in our peer group, by compensation element (see(please see “External Market Competitiveness and Peer Group” below for further details). Our CompensationC&MD Committee considers all of the information presented, discusses the recommendations with our CEO and with FW Cookour independent compensation consultant and applies its judgment to determine the elements of compensation and target compensation levels for each executive officer other than the CEO.

Our CEO also provides a self-assessment of his achievements for the prior year. Our CompensationC&MD Committee reviews and considers this in analyzing the CEO’s performance, and in recommending for approval by our Board of Directors, the compensation of our CEO. Our CEO does not participate in any deliberations regarding his own compensation.

Executive Compensation Philosophy and Objectives

Our executive compensation programs are designed to drive the creation of long-term stockholder value by deliver-

| | | | |

35 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

ingdelivering performance-based compensation that is competitive with our peer group in order to attract and retain extraordinary leaders who can perform at high levels and succeed in a demanding business environment. We aim to achieve this by designing programs that are:

| • | | Mission Focused and Business Driven. Our executive compensation programs support the relentless pursuit of delivering meaningful and innovative therapies to patients by providing our executives with incentives to achieve the near- and long-term objectives of our business. Substantially all of our executive incentive compensation programs are tied directly, and meaningfully, to Company performance. Our objective is to emphasize the importance of achieving short-term goals while building and sustaining a foundation for long-term success. |

| • | | Competitively Advantageous. We benchmark our executive compensation programs against a peer group of biotechnology and pharmaceutical companies that we believe are representative of the companies we primarily compete with for talent, balanced with factors such as business scope and size, including revenues and market capitalization, business focus and geographic scope of operations. We consider peerPeer group practices as one ofare among the many factors to be takenwe take into account in developing compensation programs that we believe are most meaningful to our leaderseffective, and the Company, and which |

| | enable us to recruit, retain and motivate our leadership team to achieve their best for Biogen and our stockholders. |

| • | | Performance Differentiated. We believe strongly inpay-for-performance and endeavor to significantly differentiate rewards by delivering the highest rewards to our best performers and little or nolesser rewards to those who do not perform atpre-established levels.meet our performance expectations. |

| • | | Ownership Aligned. At Biogen, we believe every employee contributes to the success of the Company and, as such, every employee has a vested interest in the Company’s success. To reinforce this alignment with our stockholders, we strongly encourage stock ownership through our equity-based compensation programs. For members of our executive team, including our NEOs, who set and lead the future strategic direction of our Company, we ensure that a significant portion of their total pay opportunities are equity-based to maintain alignment between the interests of our executive officers and our stockholders. |

| • | | Flexible. We are committed to providing flexible benefits designed to allow our diverse global workforce to have reward opportunities that meet their varied needs so that they are inspired to perform their very best on behalf of patients and stockholders each day. |

External Market Competitiveness and Peer Group

MarketWe consider market practices are one of the considerations taken into accountand trends when determining executive compensation levels and compensation program designs at Biogen. We do not target a specific market percentile or simply replicate the market practice. Instead, we review external market practices as a reference point to assist us in providing programs designed to attract, retain and inspire extraordinary talent. Our CompensationC&MD Committee also uses a peer group to provide context for its executive compensation decision-making. Each year our independent compensation consultant reviews the external market landscape and evaluates the composition of our peer group for appropriateness.

Our CompensationC&MD Committee reviews the information provided from internal sources as well as the information provided by our independent compensation consultant to select our peer group based on comparable companies that approximate (1) our scope of business, including revenues and market capitalization, (2) our global geographical reach, (3) our research-based business with multiple marketed products and (4) a comparable pool of talent for which we compete.

The peer group for determining our February 20172018 compensation decisions consisted of biotechnology and pharmaceutical

| | | | |

| 38 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

companies, as we compete with companies in both of these sectors for executive talent.

|

|

| Biotechnology Peers |

Alexion Pharmaceuticals, Inc. Amgen Inc. Celgene Corporation Gilead Sciences Inc. Vertex Pharmaceuticals International, Inc. |

|

| Pharmaceutical Peers |

AbbVie Inc. Allergan plc Bristol-Myers Squibb Company Eli Lilly and Company Endo Health Solutions Merck & Co, Inc. Mylan N.V. Bausch Health Companies (f/k/a Valeant Pharmaceuticals IncorporatedIncorporated) |

For each of the companies in our peer group, where available, we analyze the company’s Compensation Discussion and Analysis and other data publicly filed during the prior year to identify the executives at such companies whose positions are comparable to those held by our executive officers. We then compile and analyze the data for each

| | | | |

36 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

comparable position. Our competitive analysis includes the structure and design of the compensation programs as well as the targeted value of the compensation under these programs.

For our executive officers other than our CEO, we may supplement the data forfrom our peer group with published compensation surveys where appropriate. For 2017,2018, consistent with past years, we used theWillisTowersWatson U.S. CDB Pharmaceutical and Health Sciences Executive Compensation Database survey (which we refer to as the Willis Towers Watson survey). We chose thisthe Willis Towers Watson survey because of the number of companies in our peer group that participate in it, the number of positions reported by the survey that continue to be comparable to our executive positions and the high standards under which we understand the survey is conducted (including data collection and analysis methodologies). All of the companies in our peer group are represented in a special cross-section of the Willis Towers Watson survey focused on our peer group, other than Bausch Health Companies (formally known as Valeant Pharmaceuticals Incorporated,Incorporated), which did not participate in the survey.

Compensation Elements

Our CompensationC&MD Committee determines the elements of compensation we provide to our executive officers. The elements of

our executive compensation programs and their objectives are as follows:

| | | | | | |

| | | |

| Element | | | | Objective(s) | | |

Base Salary | | • | | Provides a fixed level of compensation that is competitive with the external market and reflects each executive’s contributions, experience, responsibilities and potential to contribute to our future success. | | |

Annual Bonus Plan | | • | | Aligns short-term compensation with the annual goals of the Company. | | |

| | • | | Motivates and rewards the achievement of annual Company and individual performance goals that support short- and long-term value creation. | | |

Long-term Incentives | | • | | Aligns executives’ interests with the long-term interests of our stockholders by linking the value of awards to increases in our stock price. | | |

| | • | | Motivates and rewards the achievement of stock price growth andpre-established corporate performance goals.goals, including those with a longer-term focus. | | |

| | • | | Promotes executive retention and stock ownership and focuses executives on enhancing long-term stockholder value. | | |

Benefits | | • | | Promotes health and wellness. | | |

| | • | | Provides financial protection in the event of disability or death. | | |

| | | • | | Providestax-beneficial ways for executives to save towards their retirement and encourages savings through competitive matches to executives’ retirement savings. | | |

Compensation Mix

Our CompensationC&MD Committee determines the general mix of the elements of our executive compensation programs. It does not target a specific mix of value for the compensation elements within these programs in either the program design or pay decisions. Rather, our CompensationC&MD Committee reviews the mix of compensation mixelements to ensure an appropriate level of performance-based compensation is apportioned to the short-term and even more to the long-term to ensure alignment with our business goals and performance.

Additionally, our CompensationC&MD Committee believes the greater the leadership responsibilities, the greater the potential impact an individual will have on Biogen’s future strategic direction. Therefore, for our executive officers, including our NEOs, additional emphasis is placed on performance-based compensation, with a particular emphasis on long-term incentives (LTI).LTI.

The 20172018 compensation mix for Mr. Vounatsos and our other NEOs was highly performance-based andat-risk; 91% of 20172018 compensation was performance-based for Mr. Vounatsos and 84% of 20172018 compensation was

| | | | |

| 39 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

performance-based for our other current NEOs, (other than Messrs. Capello and Covino), assuming target level achievement of applicable corporate performance goals and with LTI awards measured at target grant date

values, and excluding Dr. McKenzie’stheone-time RSU award,transition awards of RSUs granted to Dr. Ehlers, Ms. Alexander and Dr. McKenzie, as described in further detail below.

Performance Goals and Target Setting Process

Early each year, our C&MD Committee reviews and establishes the pay levels of each element of total compensation for our executive officers. Total compensation is comprised of base salary, annual bonus and LTI awards.

As part of this process, our C&MD Committee reviews the mix of compensation elements to ensure our performance-based compensation is apportioned appropriately and aligns with our business goals and performance. Our C&MD Committee also ensures that the performance metrics and goals are aligned with the annual business plan approved by our Board of Directors so there is full alignment of executive incentive goals with the goals that have been established for the year. Executive officers are also evaluated based on qualitative factors, such as individual, strategic and leadership achievements. The use of both quantitative and qualitative metrics, as well as the weighting of such metrics, effectively mitigates the impact of a single risk, such as dependence on drug pricing, pipeline performance or market share, on overall compensation.

| | | | |

3740 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

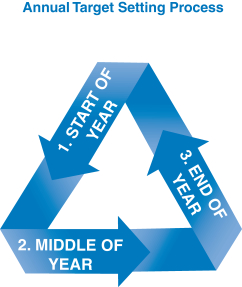

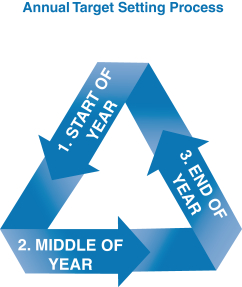

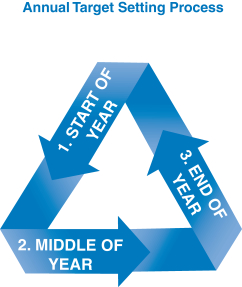

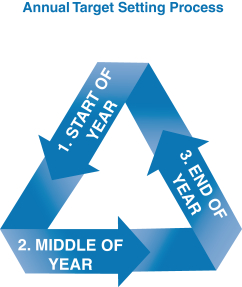

Performance Goals and Target Setting Process

Early each year, our Compensation Committee reviews and establishes the pay levels of each element of total compensation for our executive officers. Total compensation is comprised of base salary, annual bonus and LTI awards. A summary of the process our CompensationC&MD Committee follows in setting compensation is described below:

| | | | |

Target Setting Target Setting

| |

Monitoring & Tracking Monitoring & Tracking

• Our CompensationC&MD Committee closely monitors the progress against the performance goals throughout the year and engages in dialogue with management on such progress. | |   Results & Awards: Results & Awards:

CompensationC&MD Committee Actions

• Reviews and certifies the annual Company results against thepre-established goals for our incentive compensation plans.

• Reviews and discusses the performance of our executive officers against their respective performance goals, including our CEO.goals. • Reviews and discusses the Company, team and individual performance of each executive officer, other than our CEO, as assessed by our CEO. • Reviews and discusses our CEO’s recommended compensation levels for each executive officer, other than himself, in the context of such executive officer’s contributions to the Company and the other factors described above. • Approves the final compensation for each NEOexecutive officer other than our CEO, including base salary, annual bonus and LTI awards. • Reviews CEO compensation and recommends to our Board of Directors for approval the compensation of our CEO, including base salary, annual bonus and LTI awards. |

• Our Compensation Committee and our CEO discuss potential goals for the upcoming year that are tied to the short- and longer-term strategic goals of the Company. • Our CompensationC&MD Committee and our CEO discuss potential goals for the upcoming year that are tied to the short- and longer-term strategic goals of the Company as well as individual goals for our executive officers.

• The annual business plan for the year is approved by our Board of Directors,Directors. As part of the approval process, our Board considers many factors relevant to our business, reputation and strategy, including pipeline and business development, pricing and patient access, market expectations and intellectual property risk. • Our C&MD Committee ensures that the performance goals and targets under our compensation plans are aligned with the approved annual business plan. • Payout levels for each performance goal are established by management and approved by our CompensationC&MD Committee. • The performance goals are then applied to the compensation opportunities for our executive officers, including NEOs, so that there is full alignment of executive incentive goals with the goals that have been established for the year. • Our CompensationC&MD Committee also reviews base salaries, bonus and LTI planning ranges, plan designs, benefits and peer group data. | | |

| | | | |

3841 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

2017 and 2018 Hiring- and Transition-Related Compensation Decisions

Arrangement with Mr. Vounatsos

In connection with Mr. Vounatsos’ appointment as our Chief Executive Officer effective as of January 6, 2017, our Compensation Committee approved, in December 2016, as part of the employment agreement he entered into with us, an increase in his annual base salary to $1.1 million and a target bonus of 125% of his annual base salary under our annual bonus plan, in each case, effective upon his appointment as our Chief Executive Officer on January 6, 2017. In addition, on February 15, 2017, he received a LTI award of CSPUs with a grant date fair value of $4,999,754 and a LTI award of MSUs with a grant date fair value of $4,868,786. The terms of the CSPUs and MSUs granted to Mr. Vounatsos are described below under the heading “Long-Term Incentives (LTI)” and the payments that Mr. Vounatsos would be eligible to receive under his employment agreement in connection with certain terminations of employment are described in further detail under the heading “Potential Payments Upon Termination or Change in Control” below. Our Compensation Committee approved these terms after reviewing peer group data provided by FW Cook.

Arrangement with Mr. Capello

In November 2017 we appointed Mr. Capello as our Executive Vice President and Chief Financial Officer, effective as of December 11, 2017.

In determining the annual and long-term compensation for Mr. Capello, our Compensation Committee followed the same compensation philosophy and objectives described in this CD&A and also took into consideration the value of compensation that Mr. Capello would have been eligible to earn had he remained employed by his prior employer. After considering the compensation opportunities that Mr. Capello would be required to forfeit in order to join us, and in order to incentivize him to do so, our Compensation Committee granted Mr. Capello aone-time cashsign-on bonus of $520,000. Our Compensation Committee also approved an annual base salary for Mr. Capello of $750,000 and, beginning in 2018, a target bonus of 70% of his annual base salary under our annual bonus plan.

Mr. Capello’sone-time cashsign-on bonus is subject to repayment to the Company in the event Mr. Capello voluntarily terminates his employment or his employment is terminated by us for cause (as defined in our 2017 Omnibus Equity Plan) or for misconduct or poor performance, as determined by us in good faith, as follows: 100% of his cashsign-on bonus is subject to repayment if such termination

occurs within the first year of his employment, 70% of his cashsign-on bonus is subject to repayment if such termination occurs within the second year of his employment and 35% of his cashsign-on bonus is subject to repayment if such termination occurs within the third year of his employment, in each case, net of applicable tax withholdings.

In connection with Mr. Capello’s appointment, our Compensation Committee also granted him a LTI award in January 2018, which consisted of performance stock units (PSUs) and MSUs with an aggregate grant date target value of $3.0 million. The terms of the PSUs and MSUs awards granted to Mr. Capello are described below under the heading “Long-Term Incentives (LTI).” Because of this grant, Mr. Capello was not eligible to receive an annual LTI award in 2018.

Arrangement with Dr. McKenzie

In February 2016 Dr. McKenzie was appointed as our Senior Vice President for Global Biologics Manufacturing & Technical Operations. As part of his appointment, Dr. McKenzie was eligible to earn aone-time LTI award of RSUs that were contingent upon his achievement of at least a “solid” performance rating for 2016. This RSU award was intended to represent a portion of the compensation that Dr. McKenzie would have been eligible to receive had he remained with his prior employer. In March 2017, based upon his 2016 performance rating, Dr. McKenzie was granted RSUs with a grant date fair value of $800,600. These RSUs vest in three equal annual installments beginning on the first anniversary of the date of grant, subject to Dr. McKenzie’s continued employment.

Dr. Scangos’ Arrangements

On January 6, 2017, Dr. Scangos ceased to be our Chief Executive Officer (which was considered a termination without cause under his employment agreement) and the Company paid him the severance benefits payable under his employment agreement, consisting of a lump sum cash payment in the amount of $7.2 million (two times his annual base salary and target annual bonus), a prorated bonus payment of $44,877 for the period January 1, 2017 through January 6, 2017, which was based on actual Company performance and deemed 100% individual performance (as provided under his employment agreement) and continuation of certain subsidized medical, dental and vision benefits until July 1, 2018. Dr. Scangos was also entitled to receive up to nine months of executive-level outplacement services at our cost; however, Dr. Scangos did not utilize these services. In addition, pursuant to the terms of his

| | | | |

39 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

employment agreement, all of his outstanding MSUs, CSPUs and stock options continue to vest as if he had remained employed by the Company for the duration of the respective award’s vesting period and all awards that require exercise by him remain exercisable until the earlier of January 7, 2020 or their respective expiration date.

Mr. Clancy’s Arrangements

Mr. Clancy voluntarily separated from the Company on July 1, 2017 and did not receive any severance benefits in connection with his separation. Mr. Clancy’s outstanding LTI awards were eligible for retirement vesting with either accelerated or continued vesting, as applicable, pursuant to the retirement provision under our 2008 Omnibus Equity Plan.

Mr. DiPietro’s Arrangements

On May 26, 2017, Mr. DiPietro ceased to be our Executive Vice President, Human Resources and ceased to be employed by us effective September 30, 2017. We provided him the severance benefits required under our executive severance policy for Executive Vice Presidents, which consisted of a lump sum payment of $2,019,413 (21 months of base salary and target bonus) and continuation of certain subsidized medical, dental and vision benefits until the earlier of (1) January 31, 2019 or (2) the date on which he becomes eligible to receive benefits through another employer. In addition, our Compensation Committee agreed to permit the continued vesting ofone-third of his outstanding LTI awards scheduled to vest on February 15, 2018, February 22, 2018, and February 23, 2018. Mr. DiPietro was also eligible to receive up to 12 months of executive-level outplacement services at our cost; however, Mr. DiPietro did not utilize these services.

2017 Base Salary

In determining Mr. Vounatsos’ base salary as our CEO, ourOur Board of Directors reviewed the base salaries of comparable chief executive officers in our peer group and considered Mr. Vounatsos’ compensation mix, capabilities, performance and future expected contributions. Based on its review, Mr. Vounatsos’ base salary was set at $1,100,000,$1,300,000, which positioned him below the 25th percentilemarket median when compared to the chief executive officers of our peer group.

Our CompensationC&MD Committee undertook a similar review when approving the base salaries for our other NEOs, which positioned them, on average, slightly below the market median compared to persons with comparable jobs within our peer group.

The annual base salary of each of our NEOs in 20172018, compared to 20162017, was as follows:

| Name | | 2016 Salary | | | 2017 Salary | | | % Increase(1) | | | 2018 Salary | | | 2017 Salary | | | % Increase(1) | |

M. Vounatsos | | $ | 750,000 | | | $ | 1,100,000 | | | 46.7% | | | | $ | 1,300,000 | | | $ | 1,100,000 | | | 18.2% | | |

J. Capello(2) | | | n/a | | | $ | 750,000 | | | n/a | | | | $ | 750,000 | | | $ | 750,000 | | | n/a | | |

M. Ehlers | | $ | 775,000 | | | $ | 794,375 | | | 2.5% | | | | $ | 834,094 | | | $ | 794,375 | | | 5.0% | | |

S. Alexander | | $ | 696,002 | | | $ | 723,842 | | | 4.0% | | | | $ | 749,177 | | | $ | 723,842 | | | 3.5% | | |

P. McKenzie | | $ | 575,000 | | | $ | 603,750 | | | 5.0% | | | | $ | 633,938 | | | $ | 603,750 | | | 5.0% | | |

G. Covino | | $ | 375,315 | | | $ | 386,574 | | | 3.0% | | | |

G. Scangos(3) | | $ | 1,500,000 | | | $ | 1,500,000 | | | — | | | |

P. Clancy | | $ | 860,470 | | | $ | 890,586 | | | 3.5% | | | |

K. DiPietro | | $ | 655,840 | | | $ | 678,794 | | | 3.5% | | | |

| (1) | Percentage increase reflects the annual merit increase for all NEOs other than for Mr. Vounatsos and, in the case of Mr. Vounatsos, represents an increase asalso includes a result of his appointment as our CEO.market adjustment. |

| (2) | Mr. Capello was hired in November 2017. The initial determination of his base salary took into account the Company’s peer group data. |

(3) | Due to the fact that Dr. Scangos’ employment terminated in January 2017 his base salary was not considered for an increase for 2017. |

20172018 Performance-Based Plans and Goal Setting

Our executive compensation programs place a heavy emphasis on performance-based compensation.

We maintain a short-term incentive plan, known as our annual bonus plan, as well as aan LTI plan.

Awards to our NEOs under our annual bonus plan arehave been made under our 2008 Performance-Based Management Incentive Plan, and awards under our LTI plan are granted under our 2017 Omnibus Equity Plan.

Awards made under our annual bonus plan are directly tied to the achievement of our corporate performance goals, which are aligned with the Company’s short- and long-term strategic plans, as well as individual performance goals.

Awards made under our LTI plan are directly tied to the performance of the price of our common stock, which alignaligns our executives’ long-term interests with the interests of our stockholders. SomeA portion of our LTIsLTI awards are also tied to the Company’s financial performance, as described below under “2017 CSPU Company Performance Targets and Results Table.“Long-Term Incentives – 2018 PSUs.”

In setting our annual goals under our short- and long-term incentive plans, in addition to our internal forecasts, we consider analysts’ projections for our performance and the performance of companies in our peer group, as well as broad economic and industry trends. We strive to establish challenging targets that result in payouts at or above target

| | | | |

40 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

levels only when Company performance warrants it. Our CompensationC&MD Committee is responsible for reviewing and approving our annual goals, targets and levels of payout (e.g., threshold, target and maximum) for our executive incentive compensation plans and for reviewing and determining actual performance results at the end of the applicable performance period.

In setting and approving the corporate performance goals for our executive officers and for the Company under both the short- and long-term incentive plans, our CompensationC&MD Committee also considers the alignment of such goals to our business plan, the degree of difficulty of attainment and the potential for the goals to encourage inappropriate risk-taking. Our CompensationC&MD Committee has determined that the structures of our executive compensation programs do not put our patients, investors or the Company at any material risk.

Annual Bonus Plan

Our annual bonus plan is a cash incentive plan that rewards near-term financial, strategic and operational performance. Our CompensationC&MD Committee reviews ourthe annual target bonus opportunities for each executive officer by job levelposition each year to ensure such opportunities areremain competitive.

No significant changes were made in 20172018 to the target annual bonus opportunities, as a percentage ofyear-end annual base salary, for any of our NEOs other than Mr. Vounatsos, whose target annual bonus opportunity was market adjusted and increased from 125% of base salary in connection with his appointment as our CEO2017 to 140% of base salary in January 2017.2018. In accordance with our policy, target annual bonus opportunities for all of our other NEOs in 20172018 were determined based on their positions as Executive Vice Presidents and, in the case of Mr. Covino, based on his position as Vice President and Chief Accounting Officer.Presidents.

| | | | |

| 42 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

The target annual bonus opportunity as a percentage ofyear-end annual base salary for each of our NEOs in 2018 compared to 2017 was as follows:

| | | | |

Name

| | 2017 Target %

| |

M. Vounatsos

| | | 125% | |

J. Capello(1)

| | | 70% | |

M. Ehlers

| | | 70% | |

S. Alexander

| | | 70% | |

P. McKenzie

| | | 70% | |

G. Covino

| | | 35% | |

G. Scangos(2)

| | | 140% | |

P. Clancy(3)

| | | 70% | |

K. DiPietro(3)

| | | 70% | |

(1) | Amount represents the target annual bonus opportunity for Mr. Capello. Based on his hire date, Mr. Capello was ineligible for payout under our 2017 annual bonus plan. |

(2) | Dr. Scangos ceased to be our Chief Executive Officer in January 2017, and received a prorated annual bonus payment pursuant to the severance provision of his employment agreement, as described in “2017 and 2018 Hiring- and Transition-Related Compensation Decisions—Dr. Scangos Arrangements” above, based on actual Company performance and assuming 100% individual performance. |

(3) | Messrs. Clancy and DiPietro each ceased to be employed by the Company during 2017 and were ineligible for payouts under our 2017 annual bonus plan. |

| | | | | | | | |

| Name | | 2018 Target | | | 2017 Target | |

M. Vounatsos | | | 140% | | | | 125% | |

J. Capello | | | 70% | | | | 70% | |

M. Ehlers | | | 70% | | | | 70% | |

S. Alexander | | | 70% | | | | 70% | |

P. McKenzie | | | 70% | | | | 70% | |

20172018 Annual Bonus Plan Design

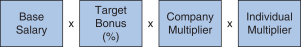

Awards for our NEOs under our 20172018 annual bonus plan were based on the achievement of Company performance goals and individual performance goals.

At the beginning of 2017,2018, our CompensationC&MD Committee set multiple Company performance goals for our 20172018 annual bonus plan and provided for a payout multiplier, which we refer to as the Company Multiplier, ranging from 0% to 150%, for each Company goal based on the determination of the level of achievement of each goal and application of the weighting previously assigned to each goal, which determined the Company Multiplier applied to the bonus calculation.

The Company Multiplier ranged from 0% to 150% as follows:

| | | | | | | | |

| | | | |

Performance Multipliers | | Below Threshold | | Threshold | | Target | | Max |

Company | | 0% | | 50% | | 100% | | 150% |

In addition, our 20172018 annual bonus plan payouts were also based on an assessment of each NEO’s individual performance, as compared totaking into account his or her achievement of individual performance goals. Our executive officers’ individual performance goals were discussed with and subject to our Compensation Committee’s approval. Our CEO’s individual goals were also approved by our Compensation Committee with input from the Chairman and the other independent directors. Evaluating individual performance allows our CompensationC&MD Committee the discretion to increase or decrease each NEO’s bonus amount based on the NEO’s individual performance by applying an individual performance multiplier, ranging from 0% to 150%, which we refer to as the Individual Multiplier.

| | | | |

41 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

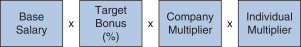

We determined the individual annual bonus payments for 20172018 using the following calculation:

Our 20172018 annual bonus plan provided that if the Company Multiplier was less than 50%, there would be no payout, regardless of individual performance.performance, further strengthening ourpay-for-performance philosophy. Further, because the

Individual Multiplier and the Company Multiplier each have a maximum of 150%, the combined multiplier result for each NEO could not exceed 225%.

20172018 Company Performance Goals and Results

Company performance goals were established at the start of 20172018 with assigned weightings that reflected the Company’s focus on attaining both financial and strategic goals (pipeline performance, MS leadership, continued SMA launch excellence and enhancing our strategic alliances).

The goals and weightings we selected reflect the importance of linking reward opportunities to both near-term results and our progress in achieving longer-term goals.

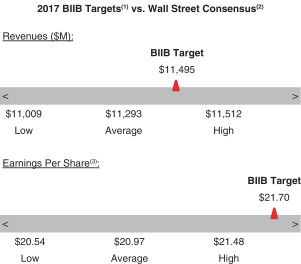

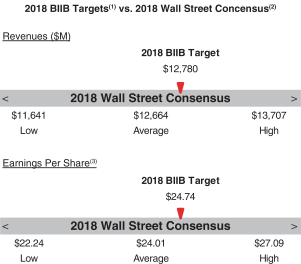

The strategic goals we selected in 20172018 were designed to measure the achievement of our annual strategic priorities relating to our commercial opportunities and pipeline progress. Our financial performance goals were based on the Company’s annual operating plan and long-range plan approved by our Board of Directors and with reference to analyst consensus for Biogen revenues andNon-GAAP

diluted earnings per share (EPS)EPS based on the most current analyst reports at the time we set our targets.

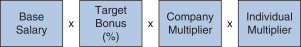

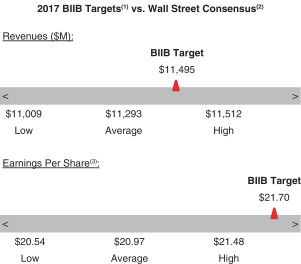

The following table presents our financial targets relative to analysts’ consensus for 2017:2018:

(1) See “2017Please see “2018 Annual Bonus Plan Company Performance Targets and Results Table” below for more details.

(2) Wall Street figures reflect estimates made in December 2016January 2018 for the Biogen fiscal year ending December 31, 2017.2018.

(3) ReflectsNon-GAAP Diluteddiluted EPS.

| | | | |

4243 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

20172018 Annual Bonus Plan Company Performance Targets and Results Table

Set forth below is a summary of the Company performance goals and weightings that our CompensationC&MD Committee established for our 20172018 annual bonus plan and the degree to which we attained these Company performance goals. As described below, the Company Multiplier for the 20172018 Annual Bonus Plan was 130%.131%, reflecting the strong performance relative to ourpre-established goals.

| | | | | | | | | | | | | | | | | | | Performance Range | | | | | | |

| | | | | Performance Range | | | | | | | | |

Company Goals | | Weight | | Threshold | | | Target | | | Max | | | Results | | | Company

Multiplier | | | Weight | | Threshold | | | Target | | | Max | | | Results | | Company Multiplier | |

FINANCIAL PERFORMANCE | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | | 20 | % | | $ | 12,310M | | | $ | 12,780M | | | $ | 13,250M | | | $ | 13,363M | (1) | | 150.0 | % |

Non-GAAP diluted EPS | | | 20 | % | | $ | 19.64 | | | $ | 21.70 | | | $ | 23.76 | | | $ | 23.19 | (1) | | | 123.0 | % | | | 20 | % | | $ | 23.47 | | | $ | 24.74 | | | $ | 26.01 | | | $ | 26.89 | (1) | | 150.0 | % |

Revenues | | | 20 | % | | $ | 10,687M | | | $ | 11,495M | | | $ | 12,303M | | | $ | 12,201M | (1) | | | 136.1 | % | |

MARKET PERFORMANCE | | | | | | | | | | | | | | | | | | | | |

Achieve U.S. SMA Market Share and Obtain SMA Approvals in E.U. and Certain Other Markets | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Above

Goal(2) |

| | | 131.3 | % | |

Achieve Global MS Market Share | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Below

Goal(2) |

| | | 96.5 | % | | | 15 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Below

Goal(2) |

| | 91.8 | % |

MS Leader in Customer Trust and Value Survey | | | 5 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Goal

Met |

| | | 100.0 | % | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Above

Goal(2) |

| | 125.0 | % |

Establish Three Outcome-based Innovative contracts | | | 5 | % | | | 1 | | | | 3 | | | | 5 | | | | 5 | | | | 150.0 | % | |

Achieve Global SMA Market Share | | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Above

Goal(2) |

| | 134.9 | % |

PIPELINE DEVELOPMENT | | | | | | | | | | | | | | | | | | | | |

Build and Advance Total Pipeline | | | 10 | % | |

| Specific pipeline goals are not

disclosed for competitive reasons |

| |

| Above

Goal(3) |

| | | 143.0 | % | | | 10 | % | |

| Specific pipeline goals

are not disclosed for competitive reasons |

| |

| Above

Goal(3) |

| | 110.0 | % |

Achieve Aducanumab Phase 3 Enrollment | | | 10 | % | |

| Specific enrollment goals are

not disclosed for competitive reasons |

| |

| Above

Goal(4) |

| | | 132.0 | % | | | 5 | % | |

| Specific enrollment goals

are not disclosed for competitive reasons |

| |

| Above

Goal(4) |

| | 105.0 | % |

COLLABORATION | | | | | | | | | | | | | | | | | | | | |

Improve Key Strategic Alliances | | | 10 | % | |

| Specific strategic

alliance goals are not

disclosed for competitive reasons |

| |

| Above

Goal(5) |

| | | 150.0 | % | |

Improve and Expand Key Strategic Alliances | | | | 10 | % | |

| Specific strategic

alliance goals are not

disclosed for competitive reasons |

| |

| Above

Goal(5) |

| | | 150.0 | % |

Company Multiplier | Company Multiplier | | | | 130.0 | %* | Company Multiplier | | | | 131.0 | %* |

| * | Numbers may not recalculate due to rounding. |

Notes to 20172018 Annual Bonus Plan Company Performance Targets and Results Table

| (1) | These financial measures were based on our publicly reported revenues of $12,274$13,453 million and our publicly announcedNon-GAAP diluted EPS of $21.81,$26.20, as adjusted as follows: for purposes of our 20172018 annual bonus plan, revenues andNon-GAAP diluted EPS were adjusted to neutralize the effects of foreign exchange rate fluctuations andfluctuations.Non-GAAP diluted EPS was further adjusted to add back $1.08$1.21 to reflect the impact of additional research and development expense recognized in 20172018 resulting from increased business development activitythe 2018 Ionis Agreement and $0.29$0.07 to neutralize the unfavorable impact of the worldwide withdrawal of ZINBRYTA, Article 20 Procedure,partially offset by the subtraction of $0.59 related to higher than originally contemplated stock repurchases in 2018, as these charges were not originally contemplated at the time the Company performance goals were determined. |

| (2) | Achievement of market goals for SMAMS was below goal and achievement of MS leader and market goals for SMA were above and below goals, respectively.goals. Specific details are not disclosed for competitive reasons. |

| (3) | The Company continued to expand andre-shape its pipeline ofpre-clinical and clinical stage programs through the advancement of internal programs, external business development activities and exceeding expectations with respect to the level of confidence in and momentum of its clinical stage portfolio. Specific details are not disclosed for competitive reasons. |

| (4) | Aducanumab Phase 3 clinical trial patient enrollment was above goal. Specific details are not disclosed for competitive reasons. |

| (5) | Key strategic alliance and acquisition activities were above goal. Specific details are not disclosed for competitive reasons. |

| | | | |

| 44 | |  | |  |

| | |

| 5 | | Executive Compensation Matters (continued) |

20172018 Individual Performance Goals and Results

The Individual Multiplier reflects each named executive officer’s overall individual performance rating as part of our performance assessment process. Unlike our formulaic calculation of corporate performance versusagainst Company per-

formanceperformance goals in determining the Company Multiplier, each named executive officer’s Individual Multiplier is based on a subjective evaluation of his or her overall performance and consideration of the achievement of individual goals established at the beginning of the year. Goals may be both quantitative and qualitative. For 2017,2018 Mr. Vounatsos recommended to our CompensationC&MD Committee an

| | | | |

43 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

Individual Multiplier for each current named executive officer other than himself based on his assessment of their individual contributions for the full year. Our CompensationC&MD Committee considered all of the information presented, discussed our CEO’s recommendations with him and its independent compensation consultant and applied its judgment to determine the Individual Multiplier for each current named executive officer. Our Board of Directors determined Mr. Vounatsos’ Individual Multiplier based on its assessment of his performance.

In its evaluation, our CompensationC&MD Committee assigned Individual Multipliers to our current named executive officers of between 130%115% and 145%140% based on the following accomplishments during 2017:2018:

Michel Vounatsos

Contributed to the achievement of record revenues of $12.3 billion$13,453 million and $26.20Non-GAAP diluted EPS for the year ended December 31, 2017.

Identified2018, versus targets of $12,780 million and took steps to create a leaner and simpler operating model to streamline our operations and reallocate resources towards prioritized research and development and commercial value creation opportunities, including the approval of a corporate restructuring program in October 2017.

Clarified and focused corporate strategy.

Made progress in defining and beginning to build a culture of excellence that values a tighter focus on priorities, faster decision making, enhanced accountability and improved teamwork.

Recruited outstanding members of our senior management team, including Dr. Gregory and Messrs. Capello and Guindo.$24.74, respectively.

Excelled in leading the Company in setting and achieving its financial goals and business development goals.

Added substantial value to our business development activities and the diversification of our pipeline.

Contributed significantly to the demonstrated resilience in our MS business, the continued successful launch of SPINRAZA worldwide.worldwide and the significant progress made in our biosimilars business.

Drove our ongoing improvements in our core processes to improve operating efficiencies, capital allocation and asset optimization while adhering to our core values.

Jeffrey D. Capello

Contributed to the achievement of record revenues of $13,453 million and $26.20Non-GAAP diluted EPS for the year ended December 31, 2018, versus targets of $12,780 million and $24.74, respectively.

Significantly improved our Finance organization structure and key processes, including improved financial forecasting and planning and tax and treasury planning.

Added substantial value to our business development activities and the diversification of our pipeline.

Contributed to the return of approximately $4.4 billion to stockholders in 2018 through share repurchases under our 2018 Share Repurchase Program and 2016 Share Repurchase Program.

Contributed to excellent interactions with investors leading to transparent and trusted dialogue.

Contributed to improvements in our core processes to improve operating efficiencies, capital allocation and asset optimization while adhering to our core values.

Supported our Board of Directors, the CEO and executive team.

Michael Ehlers

Exceeded portfolio value and clinical development goals.

Significantly progressed and developed our pipeline.

Significantly improved our Research and Development organization structure, key processes and productivity.

Exceeded portfolio value and clinical development goals.

Added new capabilities and talent to our Research and Development organization.

Excelled in leadership of our Research and Development organization.

Added substantial value to our business development activities.

Contributed to excellent interactions with investors leading to transparent and trusted dialogue.

Susan H. Alexander

Supported our Board of Directors, the CEO and executive team transition and SEC disclosure requirements.

Led our initiative to create a leaner and simpler operating model to streamline our operations and reallocate resources towards prioritized research and development and commercial value creation opportunities, including the approval of a corporate restructuring program in October 2017.

Strengthened the intellectual property rights of our key assets, including our settlement and license agreement with Forward Pharma, pursuant to which we obtained U.S. and rest of world licenses to Forward Pharma’s intellectual property, including Forward Pharma’s intellectual property related to TECFIDERA.

Excelled in leadership of our Legal and Compliance teams while at the same time taking on leadership of our Corporate Services organization.teams.

Contributed significantly and excellently on strategy and the resolution of general business issues affecting the Company.Company, including our expansion into Asia Pacific and Latin America.

Supported the effective transition of the corporate services functions, including IT, to Mr. Capello.

Paul F. McKenzie

Excelled in management of our large and complex manufacturing organization.

Maintained excellence in manufacturing plant quality.

Contributed significantly to the successful launch of SPINRAZA worldwide.

Contributed significantly and excellently on strategy and general business issues affecting the Company.

Enhanced discipline and rigor with respect to decision making in our Pharmaceutical Operations & Technology organization.

Exhibited outstanding leadership, fostering a culture of continuous improvement and cost-consciousness.

Gregory F. Covino

Provided excellent leadership and support across our Finance organization following the departure of Mr. Clancy as our CFO in July 2017, including acting as our Interim Principal Financial Officer.

Supported the effective transition of Mr. Capello as our CFO.

Helped lead the Company in achieving its financial goals and performance.

Contributed significantly and excellently on strategy and general business issues affecting the Company.

Added substantial value to our business development activities.

| | | | |

44 | |  | |  |

| | |

5 | | Executive Compensation Matters (continued)

|

In addition, our Compensation Committee reviews on a qualitative basis each named executive officer’s other contributions that are not covered by the individual performance

goals, leadership competencies and relative performance among our named executive officers.

2017 Annual Bonus Plan Awards

Our Compensation Committee determined that the final bonus awards under our 2017 annual bonus plan were as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Year-end Salary (A) x | | | Target Bonus% (B) x | | | Company

Multiplier (C) x | | | Individual Multiplier (D) = | | | Bonus Award (E) | |

M. Vounatsos | | $ | 1,100,000 | | | | 125 | % | | | 130 | % | | | 140 | % | | $ | 2,502,500 | |

J. Capello(1) | | $ | 750,000 | | | | 70 | % | | | n/a | | | | n/a | | | | n/a | |

M. Ehlers | | $ | 794,375 | | | | 70 | % | | | 130 | % | | | 140 | % | | $ | 1,012,034 | |